Even with Medicare, retirees face significant out-of-pocket costs because the program doesn't cover all health care needs.

Avg. monthly cost of in-home care in California

Avg. monthly cost of semi-private room in a California skilled nursing facility

Avg. monthly cost of a private room in a California skilled nursing facility

Long term care insurance helps cover expenses for community programs, assisted living, and other expenses.

Calculators

Calculators

Planning Tools

These calculators and planning tools will provide insight into your future needs.

Additional Information

Additional Information

Videos

These quick videos will provide additional information in your long term care funding research.

Solutions

Solutions

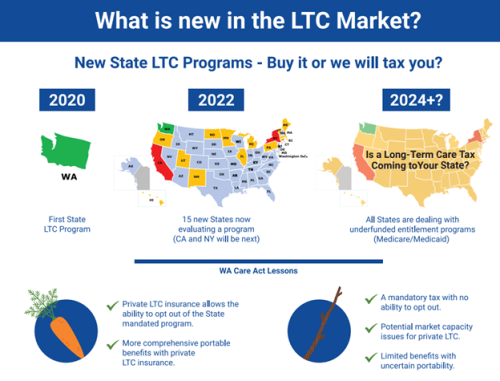

New Taxes?

As many states struggle to meet the soaring demands of their Medicaid long-term care programs, many are considering increasing taxes on their citizens.

Washington recently enforced a mandatory payroll tax for its citizens to fund a small LTC benefit plan, and an additional fifteen states are considering taking similar measures.

If the Washington example is followed in your State, buying private long-term care plans could provide an exemption from this mandatory state tax and more comprehensive coverage.

California has enacted Assembly Bill 567 to establish a long-term care task force to examine the feasibility of designing and implementing a mandatory statewide LTC Insurance program.

The Problem Hasn’t Changed But the Solutions Have

An overview of our LTC Funding solutions can be found on the chart. Each option has its benefits and drawbacks, and your medical situation is an important factor in the options available to you.

Products do vary by State. Michael can provide you with an analysis of the options in your state and aid you in deciding if one is right for you and your family.

With LTCRplus, our team of experts brings you 25 years of experience to deliver the most affordable and comprehensive solutions for all your Long-Term Care (LTC) Funding requirements.

Thanks to collective buying power, we offer exclusive discounted rates with group and individual products. Our portfolio of best-in-class solutions can accommodate different budgets, medical conditions, and levels of coverage.

Meet your advisor

Michael Barrett is an independent insurance professional with over 20 years of experience in financial services. Michael resides in Orange County, CA and is part of the LCTR Pacific team, an insurance agency working with over 650 affinity groups and associations.

Michael is dedicated to helping individuals and families secure their financial futures. He works closely with clients to tailor solutions that match their unique needs and goals. Whether it's long term care or life insurance, Michael provides expert guidance and peace of mind in planning for the unexpected.

Why Long Term Care?

Recent research suggests that most Americans turning age 65 will need LTC services at some point in their lives. Women typically need care for 3.7 years, while men require 2.2 years, however, 20% will need care for 5+ years.

Is MediCare sufficient?

Regular health insurance doesn't cover long term care and MediCare covers only short nursing home stays (max. 100 days) or limited amounts of home health care in specific instances.

Are you prepared?

Long Term Care can deplete ones retirement savings quickly. The median cost of care in a private room is $108,408. The financial impact of LTC can be devastating and given the rising costs of health care, planning for the future has never been more important.

Why wait?

The longer you wait, the more expensive your options become and the higher your risk is of becoming uninsurable. Plan now while you still can, taking the stress and financial responsibility off your family.